Polyurethane, with its core advantages such as lightweight, weather resistance and multi-functional integration, has become a key material in automotive manufacturing. With the explosive growth of the global new energy vehicle industry and the upgrading of environmental protection regulations, the application boundaries of polyurethane in the automotive field have continued to expand, and the market shows the dual characteristics of "steady increase in traditional demand and explosive growth in emerging fields". The following is an in-depth analysis based on the latest industry data.

I. Market Size: Steadily expanding globally, with China becoming the core engine of growth

The global automotive polyurethane market is in a period of accelerated growth, and China has become a core growth pole due to its leading position in the new energy vehicle industry.

Global market size: In 2024, the global market size of automotive polyurethane exceeded 32 billion US dollars, with the automotive sector accounting for 28%. It is estimated that the global demand for polyurethane in the automotive industry will exceed 4.5 million tons in 2026, with a compound annual growth rate maintained at over 8.2%.

Chinese market performance: The demand for automotive polyurethane in China reached 1.8 million tons in 2024 and is expected to increase to 2.25 million tons in 2025, representing a year-on-year growth of 25%. Among them, the increment contributed by new energy vehicles accounted for over 60%, mainly due to the fact that the polyurethane usage per vehicle was 15 kilograms higher than that of traditional fuel vehicles.

Regional competitive landscape: The Asia-Pacific region (with China at its core) holds 42% of the global market share, Europe (mainly Germany and France) accounts for 27%, and North America accounts for 21%. The growth rate of the Chinese market (13.7%) is significantly higher than the global average, and it is expected that its share of the global market will rise to 45% by 2026.

Ii. Application Structure: Full-scenario coverage from traditional interiors to core components of new energy vehicles

The application of polyurethane in the automotive field has formed a pattern of "laying a foundation in traditional categories and making breakthroughs in emerging fields", and new energy vehicles are driving the reconstruction of the application structure

(1) Traditional applications: The interior and seats remain the basic components

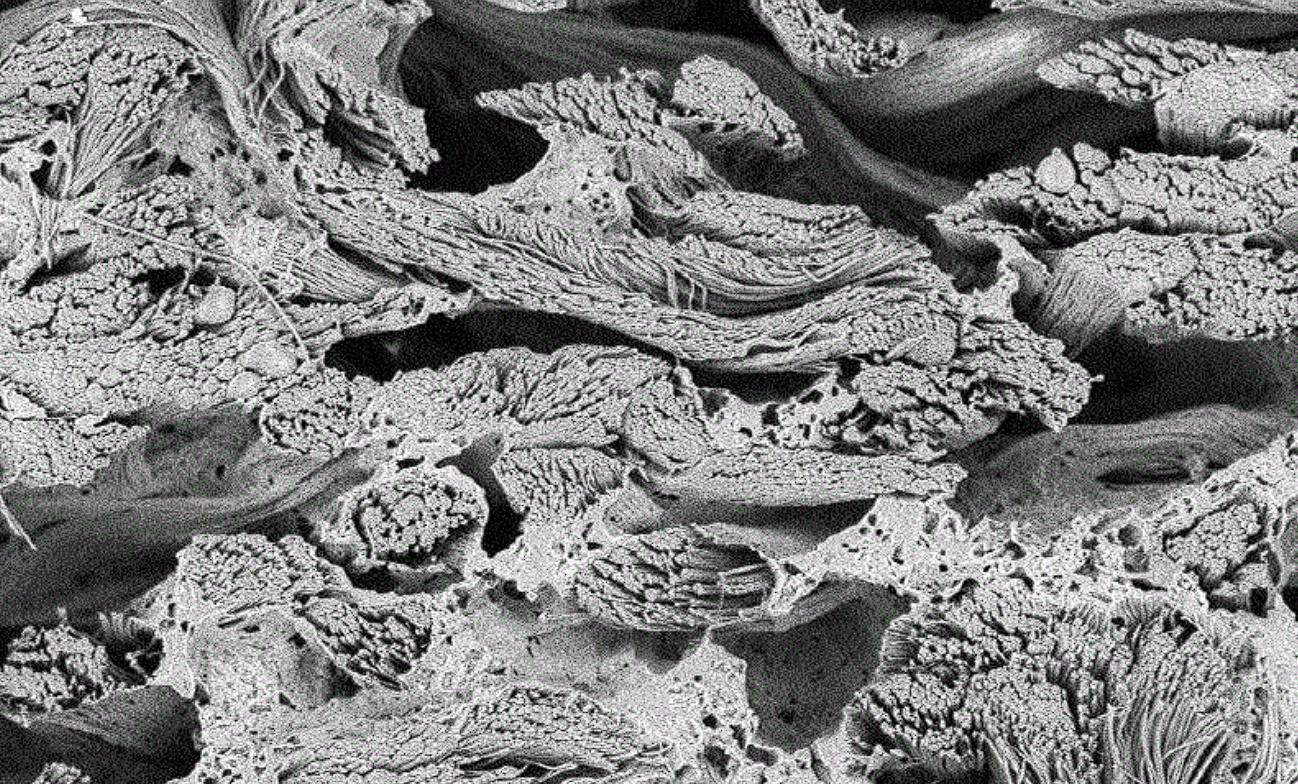

Automotive interior leather: PU leather, due to its high simulation degree and strong stain resistance, occupies over 90% of the automotive seat and door panel interior market. High-end vehicle models have a strong demand for PU leather with low VOC emissions (< 0.5ppm) and anti-aging properties. The penetration rate of CertiPUR-US® certified products has reached 65%. The market size of polyurethane powder coatings for automobiles in China reached 750 million yuan in 2023 and is expected to increase to 1.18 billion yuan by 2025.

Seats and sound insulation foam: Soft polyurethane foam is the core filling material for car seats. To optimize the driving range, new energy vehicle models tend to use lightweight foam with a density of 30-40kg/m³, with a single vehicle usage of approximately 8-12 kilograms. Huntsman's acoustic foam can reduce noise inside vehicles by 3 to 5 decibels and has been equipped on models such as BMW iX and BYD Han.

(2) Emerging growth points driven by new energy vehicles

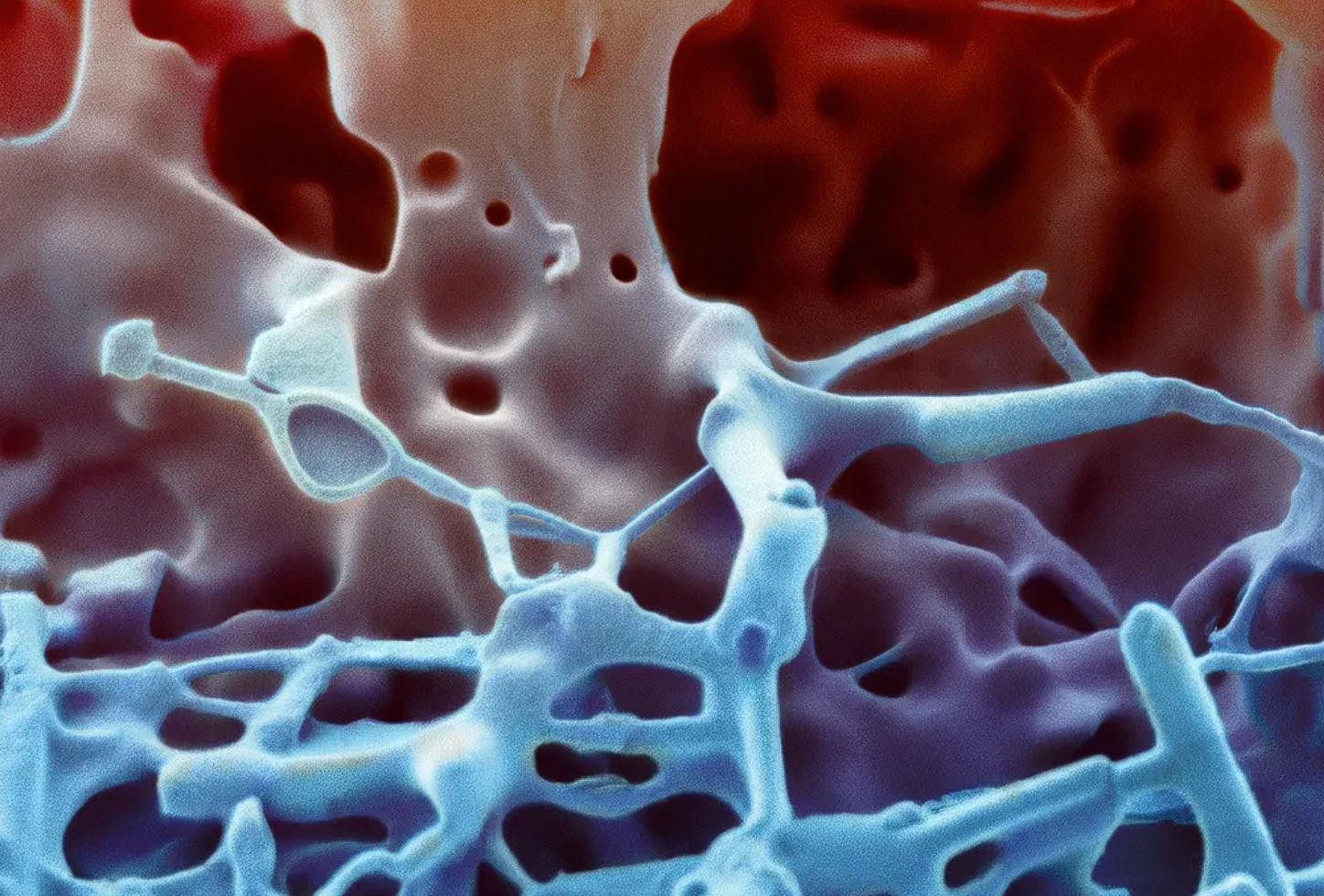

Battery pack protection materials: Polyurethane sealant and foaming materials, due to their excellent water resistance (IPX7 level) and resistance to high and low temperatures (-40℃ to 85℃), have become the core protection solutions for battery packs. The penetration rate of battery pack sealing materials will jump from 12% in 2023 to 27% in 2025, and the market size will exceed 3.5 billion yuan. The permanent deformation rate of polyurethane foam used in battery packs by Wanhua Chemical is less than 5%, and it has been matched with battery cell modules of CATL.

Motor and electronic component packaging: Modified polyurethane materials can achieve insulation packaging of motor coils, with a breakdown voltage resistance of up to 30kV/mm, and are 20% lighter than traditional epoxy resins. In 2024, the demand in this field will increase by 42% year-on-year, mainly supporting Tesla's 4680 motor and BYD's Blade battery electronic control system.

Lightweight structural components: The application of polyurethane composite materials in body panels and chassis parts is gradually expanding, which can reduce the weight of components by 30% to 40%. A certain new energy vehicle manufacturer has adopted polyurethane-carbon fiber composite doors, reducing the weight of each vehicle by 18 kilograms and increasing the range by approximately 25 kilometers.

Iii. Core Driving Factors: The triple resonance of policy, technology and market

Mandatory upgrade of policies and regulations

In terms of environmental protection: The European EU 6d emission standard requires that the VOC emissions in vehicles be less than 0.1mg/m³, promoting the substitution of low-volatile polyurethane materials. China's "dual credit policy" has prompted automakers to reduce fuel and electricity consumption through lightweight materials, with the per-vehicle usage of polyurethane increasing by 12% to 18%.

Support for the new energy industry: China's penetration rate of new energy vehicles is expected to exceed 60% by 2025. Policy subsidies are inclined towards lightweight and high-safety models, directly driving the demand for polyurethane used in battery packs.

Technological innovation breaks through application bottlenecks

Material modification: Bio-based polyurethane (with a proportion of vegetable oil derived polyols exceeding 30%) has achieved mass production, reducing the carbon footprint by 25%. It has been applied to the seat foam of NIO ET5.

Process upgrade: The low-temperature curing technology for polyurethane powder coatings (140℃/20min) has been broken through, meeting the coating requirements of new energy vehicle parts. Byd and XPeng have already achieved large-scale application.

Market demand iteration drive

Consumers' attention to in-car health has increased, and the demand for hypoallergenic and antibacterial PU interior leather has grown by 38%. Data from a certain automaker shows that the order conversion rate of models with eco-friendly PU interiors has increased by 15%.

Intelligent driving drives functional demands, and innovative products such as polyurethane anti-slip MATS integrated with sensors and repairable interior films have entered the mass production stage.

Iv. Competitive Landscape: Differentiated Competition between Global Giants and Local Enterprises

International leading enterprises

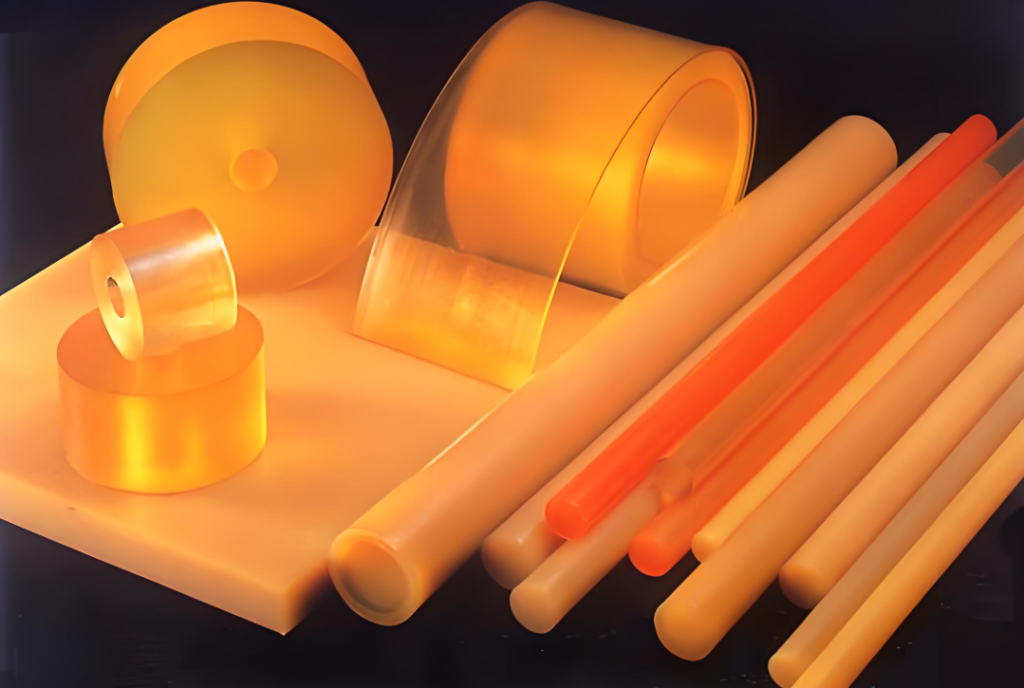

Basf: Focusing on the high-end market, its Elastollan® series of polyurethane elastomers account for 35% of the global automotive sealing parts market, and are supplied to luxury brands such as Mercedes-Benz and BMW.

Huntsman: It has a significant advantage in the field of acoustic foam, with a global market share of 28% for automotive polyurethane system materials and over 50% of its customers in the new energy vehicle sector.

Local leading enterprises

Wanhua Chemical: With the advantage of MDI raw materials, its market share in the battery pack sealant field has reached 32%, and its revenue from automotive polyurethane is expected to increase by 41% year-on-year in 2024.

Supporting enterprises: Ningbo Shanshan and Changzhou Plana, specializing in polyurethane powder coatings, have entered the supply chains of BYD and NIO. Their output is expected to increase by 65% year-on-year in 2024.

The focus of competition: International enterprises emphasize technological premium and global supply chains, while domestic enterprises seize the mid-to-high-end market with cost control (15%-20% lower than imported products) and rapid response (shortening the customization cycle to 7 days).

V. Challenges and Future Prospects

(1) Existing challenges

Fluctuations in raw material prices: The annual fluctuation rate of MDI prices reaches 25% to 30%, squeezing the profit margins of enterprises.

The recycling technology lags behind: The cross-linked structure leads to a polyurethane recycling rate of less than 15%, facing environmental protection pressure.

The technical barriers are relatively high: Polyurethane used in high-end battery packs needs to pass 1,000 charge and discharge cycle tests, and the pass rate of domestic enterprises is only 40%.

(II) Future Trends

Green materials: By 2030, the penetration rate of bio-based polyurethane in the automotive field will reach 40%, and the carbon footprint will be further reduced by 30%. The chemical enzymatic recovery technology has achieved mass production, with a recovery utilization rate exceeding 60%.

Functional integration: Develop a "three-in-one" polyurethane material with thermal conductivity, insulation and flame retardancy to meet the battery requirements of 800V high-voltage platforms.

Intelligent collaboration: Polyurethane composite materials integrated with temperature/pressure sensors enable real-time monitoring of battery pack status. It is expected that the matching rate will reach 50% by 2027.

Summary

The market of polyurethane in the automotive field is undergoing a transformation from "traditional auxiliary material" to "core functional material", with the explosive growth of new energy vehicles being the core driving force. In the next five years, the Chinese market will continue to lead global growth, and domestic enterprises are expected to achieve import substitution in the medium and high-end fields through technological breakthroughs. Enterprises need to focus on three major directions: bio-based materials, recycling technologies and functional integration in order to seize the initiative in the structural transformation.